Hey there! Interested in making some extra cash by trading stocks or cryptocurrencies online? Well, you’re in the right place! In this article, we’ll dive into the exciting world of online trading and show you how you can potentially earn money from the comfort of your own home.

Curious to know more? We’ve got you covered! In the upcoming paragraphs, we’ll discuss the ins and outs of trading stocks and cryptocurrencies online. We’ll explore different strategies, provide you with useful tips, and guide you through the process step by step. So, whether you’re a beginner or already have some experience in the field, get ready to enhance your knowledge and increase your chances of making profitable trades. Stay tuned, and let’s get started on your journey to earning money through online trading!

How to Earn Money by Trading Stocks Online

If you’ve ever wondered whether you can make money by trading stocks or cryptocurrencies online, the answer is yes! Online stock trading has become increasingly popular in recent years, providing individuals with the opportunity to invest in the financial markets and potentially earn a profit. However, it’s important to understand the ins and outs of online stock trading before diving in. In this article, we will explore the basics of online stock trading, the benefits it offers, and provide you with tips on how to get started, develop a trading strategy, manage risks, and execute trades effectively.

Understanding Online Stock Trading

What is Online Stock Trading?

Online stock trading is the process of buying and selling stocks or other financial assets through a digital platform. Instead of physically visiting a stock exchange or relying on a broker to make trades on your behalf, online trading platforms allow you to trade stocks from the comfort of your own home or anywhere with an internet connection. These platforms provide access to real-time market data, research tools, and trading options, enabling you to make informed decisions about buying and selling stocks.

Benefits of Online Stock Trading

Online stock trading offers several advantages over traditional methods of trading. Firstly, it provides flexibility and convenience. With online trading, you have the freedom to trade at any time of the day or night, allowing you to take advantage of market opportunities as they arise. Additionally, online trading platforms are user-friendly and easy to navigate, making it accessible to both beginners and experienced traders. Furthermore, online trading often requires lower fees compared to traditional trading methods, allowing you to keep more of your profits.

Getting Started with Online Stock Trading

Choosing a Reliable Trading Platform

The first step to getting started with online stock trading is selecting a reliable trading platform. There are numerous options available, so it’s important to do your research and choose a platform that meets your specific needs. Look for a platform that provides a user-friendly interface, robust security measures, competitive pricing, and access to a wide range of stocks and investment instruments. Some popular online trading platforms include eToro, TD Ameritrade, Interactive Brokers, and Robinhood.

Opening an Online Trading Account

Once you’ve chosen a trading platform, the next step is to open an online trading account. The account opening process typically involves providing personal information, such as your name, address, and identification documents. You may also need to complete a questionnaire to assess your investment knowledge and risk tolerance. Once your account is opened and verified, you can fund it by transferring money from your bank account or depositing funds directly.

Understanding Different Order Types

Before you start trading, it’s important to understand the different types of orders you can place. The most common order types include market orders, limit orders, and stop-loss orders. A market order is executed at the best available price at the time of placing the order. This type of order is typically used when you want to buy or sell a stock immediately. A limit order, on the other hand, allows you to set a specific price at which you want to buy or sell a stock. The trade will only be executed if the stock reaches your specified price. Finally, a stop-loss order is used to limit your potential losses by automatically selling a stock if its price falls below a certain level.

Developing a Trading Strategy

Setting Financial Goals

Before you start trading, it’s important to set clear financial goals. Ask yourself what you hope to achieve through trading stocks. Are you looking to make a long-term investment for retirement? Or are you interested in generating short-term profits? Setting realistic goals will help guide your trading decisions and keep you focused on your desired outcomes.

Analyzing Market Trends

To develop a successful trading strategy, you need to analyze market trends and identify potential opportunities. This involves studying historical price data, analyzing market indicators, and keeping up-to-date with news and events that can impact the financial markets. Technical analysis tools, such as candlestick patterns, moving averages, and the relative strength index (RSI), can help you identify trends and make more informed trading decisions.

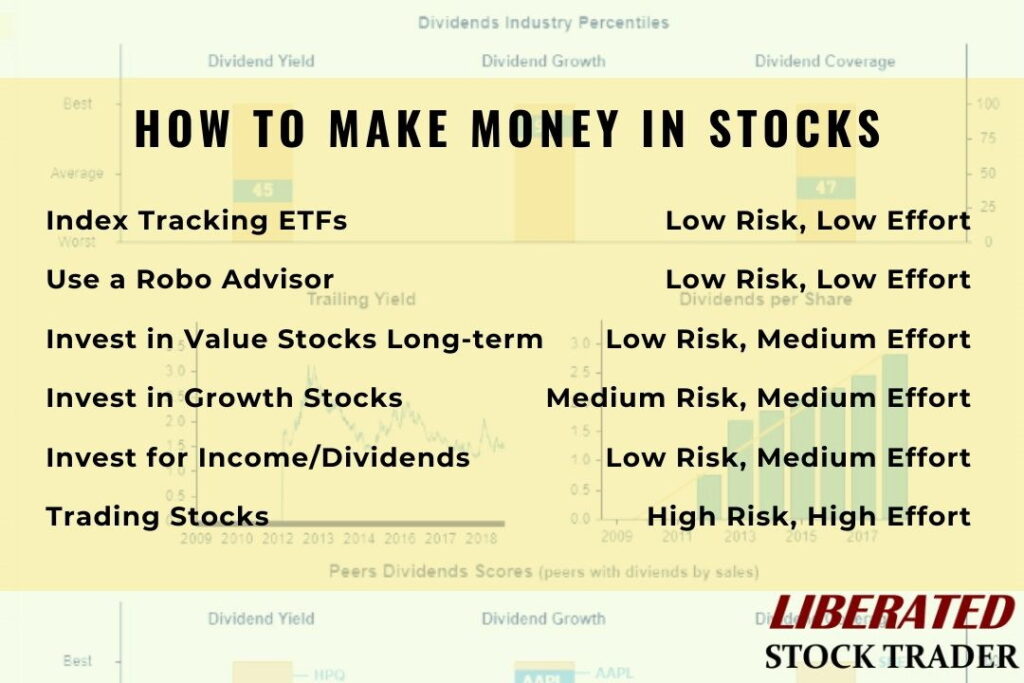

Identifying Suitable Trading Techniques

There are several trading techniques you can use to execute trades effectively. Some popular techniques include day trading, swing trading, and value investing. Day trading involves buying and selling stocks within a single trading day, taking advantage of short-term price fluctuations. Swing trading, on the other hand, involves holding stocks for a few days to several weeks, capitalizing on medium-term price swings. Value investing focuses on finding undervalued stocks and holding them for the long term, with the expectation that their value will eventually increase.

Managing Risks in Stock Trading

Diversifying Investment Portfolio

One of the most important aspects of managing risks in stock trading is diversifying your investment portfolio. Diversification involves spreading your investments across different asset classes, sectors, and geographic regions. By diversifying your portfolio, you can reduce the impact of any single investment on your overall portfolio and minimize the risk of significant losses.

Setting Stop-Loss Orders

Another risk management technique is setting stop-loss orders. A stop-loss order allows you to specify a price at which you want to automatically sell a stock if its price falls below a certain level. By setting stop-loss orders, you can limit your potential losses and protect your capital in case the market moves against you.

Avoiding Emotional Trading

emotional trading is one of the biggest mistakes traders make. It’s important to keep your emotions in check and stick to your trading plan. Avoid making impulsive decisions based on fear or greed. Instead, rely on your research, analysis, and trading strategy to guide your trading decisions.

Technical Analysis and Charting Tools

Understanding Candlestick Patterns

Candlestick patterns are an important tool in technical analysis. They provide valuable information about the price action and sentiment of the market. There are various candlestick patterns, such as doji, hammer, engulfing, and shooting star, each indicating different market conditions and potential reversals.

Utilizing Moving Averages

Moving averages are widely used by traders to identify trends and potential entry and exit points. A moving average is calculated by taking the average price of a stock over a certain period of time. By comparing the current price to the moving average, traders can determine whether the stock is trending up or down.

Applying Relative Strength Index (RSI)

The relative strength index (RSI) is a momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought and oversold conditions in the market, which can be used as signals for potential reversals. The RSI ranges from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions.

Fundamental Analysis for Stock Trading

Evaluating Company Financials

Fundamental analysis involves evaluating a company’s financial performance, management team, competitive advantage, and overall business prospects. By analyzing financial statements, such as income statements, balance sheets, and cash flow statements, you can assess the financial health and profitability of a company.

Analyzing Industry and Market Trends

In addition to evaluating individual companies, it’s important to analyze industry and market trends. By understanding the factors that can impact an industry’s growth or decline, you can make more informed investment decisions. Pay attention to factors such as market demand, competition, technological advancements, and regulatory changes.

Assessing Competitive Advantage

Assessing a company’s competitive advantage is crucial when selecting stocks to trade. Competitive advantage refers to the unique qualities or resources that give a company an edge over its competitors. Look for companies that have a strong brand, unique products or services, a loyal customer base, or a superior distribution network.

Executing Stock Trades Online

Placing Buy and Sell Orders

The execution of stock trades is a critical aspect of online stock trading. To place a buy or sell order, you need to specify the quantity of stocks you want to trade and the order type, whether it’s a market order or a limit order. Make sure to review your order before confirming to ensure accuracy.

Executing Market Orders

Market orders are executed at the prevailing market price at the time of placing the order. They are typically used when you want to buy or sell a stock immediately, without setting a specific price. It’s important to note that market orders may be subject to slippage, which is the difference between the expected price of a trade and the actual price at which it is executed.

Implementing Limit Orders

Limit orders allow you to set a specific price at which you want to buy or sell a stock. The trade will only be executed if the stock reaches your specified price. Limit orders give you more control over the price at which you enter or exit a trade, but there is a risk that the trade may not be executed if the stock does not reach your specified price.

Monitoring and Reviewing Trades

Tracking Performance and Profit/Loss

To assess the success of your trading strategy, it’s important to track the performance of your trades and calculate your profit or loss. Keep a record of each trade, including the date, stock symbol, entry and exit prices, and the profit or loss made. Regularly review your trades to identify patterns, strengths, and weaknesses in your trading strategy.

Analyzing Trade Execution

Analyzing trade execution involves reviewing the quality of your trade entries and exits. Determine if your orders were executed at the expected prices or if there was a significant difference. If there are issues with trade execution, such as slippage or delayed order fulfillment, it may be necessary to reassess your trading platform or make adjustments to your trading strategy.

Making Adjustments to Trading Strategy

Based on your analysis of trade performance and execution, you may need to make adjustments to your trading strategy. This could involve refining your entry and exit criteria, adjusting your risk management techniques, or exploring new trading techniques. It’s important to continually adapt and refine your strategy based on market conditions and your own experiences.

Advanced Trading Strategies

Short Selling and Margin Trading

Short selling and margin trading are advanced trading strategies that involve borrowing shares or funds to sell in the hope of buying them back at a lower price. Short selling allows you to profit from a decline in stock prices, while margin trading enables you to amplify your purchasing power by borrowing funds from your broker.

Options and Futures Trading

Options and futures trading are derivatives contracts that allow you to speculate on the price movements of underlying assets, such as stocks or commodities, without actually owning the assets. These trading instruments provide opportunities to profit from both rising and falling markets, but they also involve higher risks and complexities compared to traditional stock trading.

Algorithmic Trading

Algorithmic trading, also known as automated trading, involves using computer programs and algorithms to execute trades based on predetermined rules and strategies. Algorithmic trading can be used to take advantage of small price differences, execute large volume trades, or react to market events more quickly than manual trading. However, it requires programming skills and a deep understanding of market dynamics.

Conclusion

Achieving success in online stock trading requires continual learning, adaptability, and a disciplined approach. While trading stocks or cryptocurrencies online can offer the potential for substantial profits, it also comes with risks. It’s essential to develop a sound trading strategy, manage risks effectively, and stay updated on market trends and developments. By following the tips and techniques outlined in this article, you can increase your chances of earning money through online stock trading. Remember that trading stocks involves risks and potential losses, so always invest within your means and be prepared to learn from both successes and failures.